Renters Insurance in and around Madison

Welcome, home & apartment renters of Madison!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

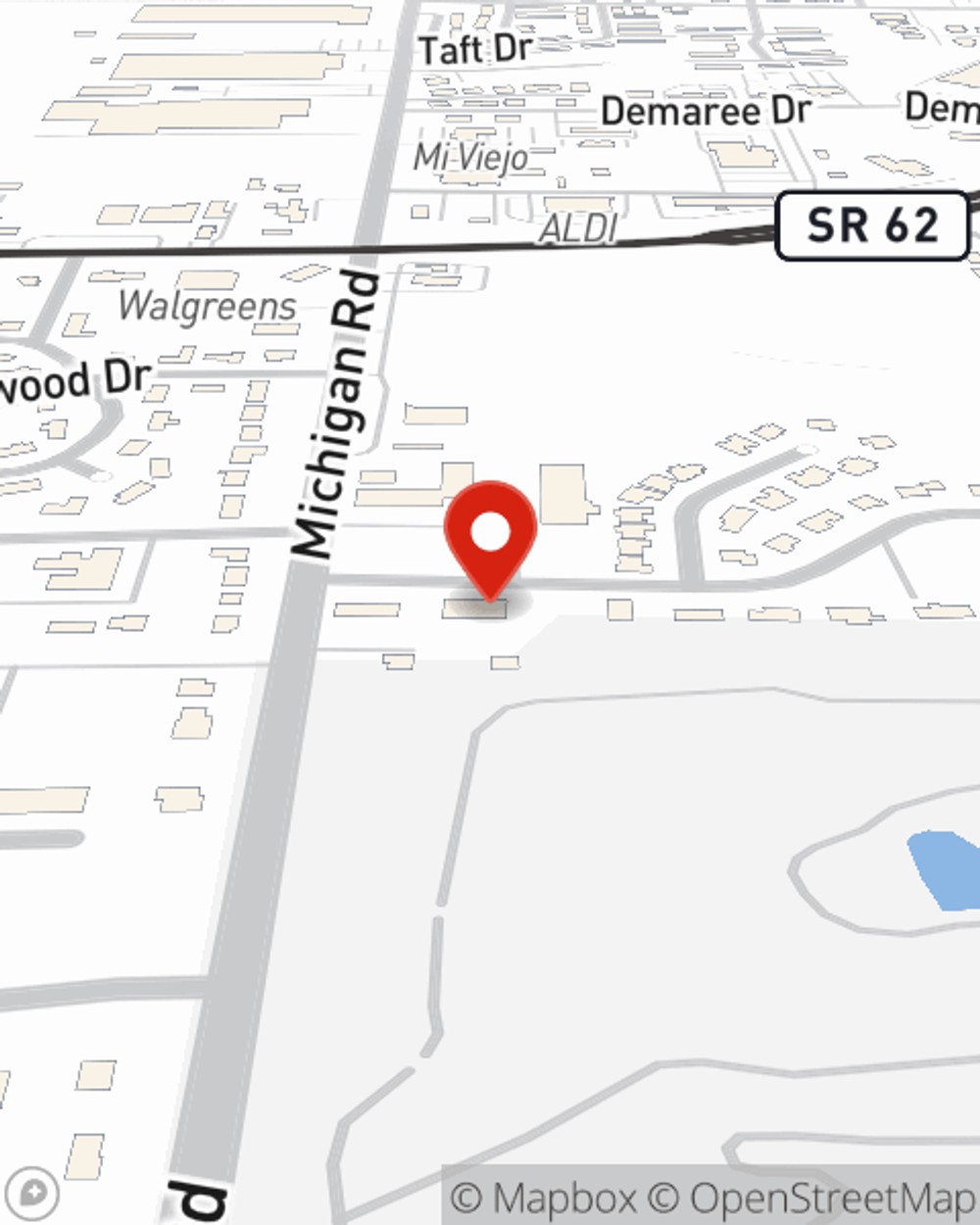

- Hanover, IN

- Madison, IN

- Jefferson County, IN

Home Sweet Home Starts With State Farm

Trying to sift through savings options and coverage options on top of family events, keeping up with friends and your pickleball league, is a lot to deal with. But your belongings in your rented home may need the remarkable coverage that State Farm provides. So when the unexpected happens, your furniture, videogame systems and souvenirs have protection.

Welcome, home & apartment renters of Madison!

Coverage for what's yours, in your rented home

Protect Your Home Sweet Rental Home

Renters insurance may seem like the last thing on your mind, and you're wondering if you really need it. But take a moment to think about what would happen if you had to replace all the valuables in your rented space. State Farm's Renters insurance can help when abrupt water damage from a ruptured pipe damage your valuables.

State Farm is a value-driven provider of renters insurance in your neighborhood, Madison. Get in touch with agent Josh Denny today and see how you can save!

Have More Questions About Renters Insurance?

Call Josh at (812) 265-6601 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.